Consumer Trends for Whiskey Reveal Surprising Insights

The US spirits category is in high spirits after experiencing 4.1% overall growth in 2015. Those percentage points translate to $72 billion in revenue for spirit producers. The spirit leading that growth is the whisk(e)y category. Every segment of the whiskey category is experiencing global sales growth. But US whiskey – Bourbon, Tennessee, and Rye – grew by 4% in 2015, which exceeds overall US spirit growth by .6%.

This is good news for whiskey producers. But lets dive deeper into these numbers and look at consumer interest for on-premise venues like restaurants and bars. These insights, pulled from Uncorkd’s proprietary digital menu data, will give readers insights into what customers actually want, and how to build a menu that capitalizes on consumer preference.

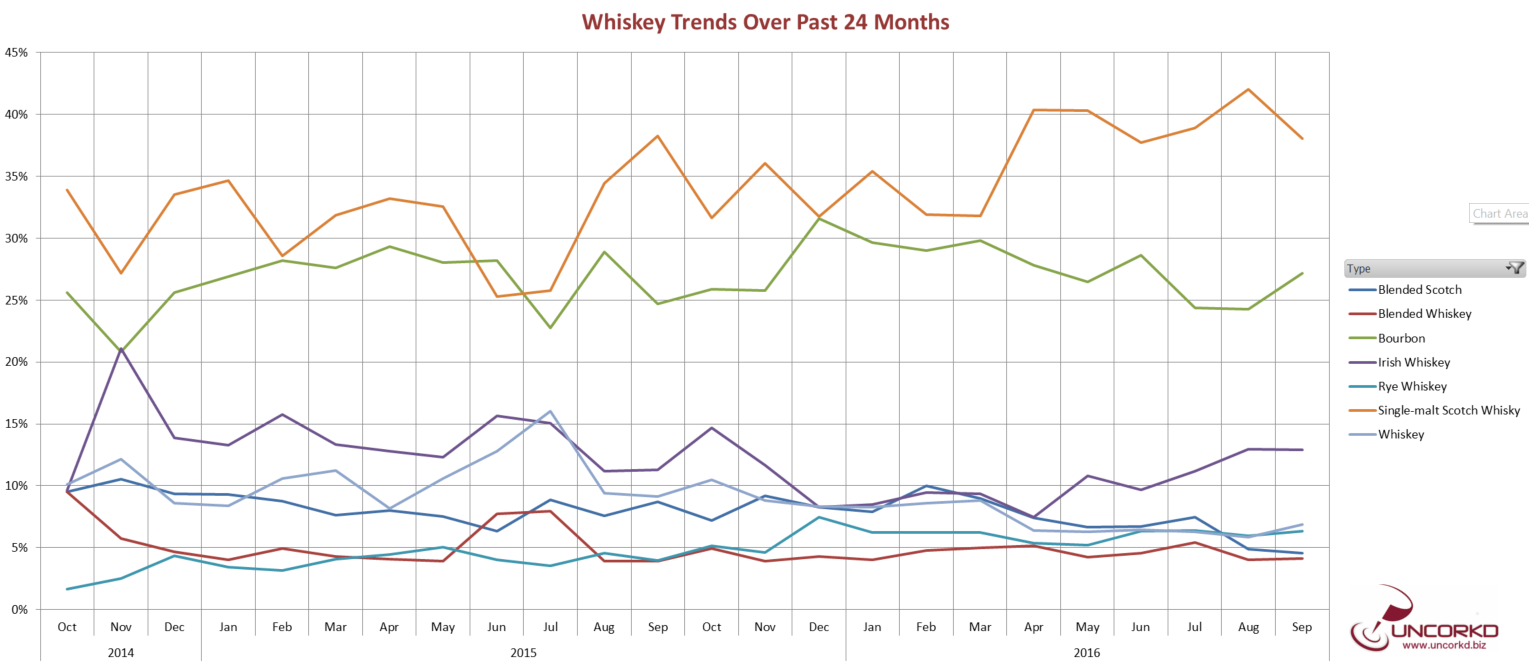

Premium Scotch Outpaces Bourbon For Consumer Interest

The US is bourbon crazy. But, according to Uncorkd’s menu data, Scotch whisky has consistently outpaced bourbon in consumer interest for the past two years. Though bourbon has eclipsed singe malt at points over the course of 24 months, single malt clearly has the highest consumer interest for the period.

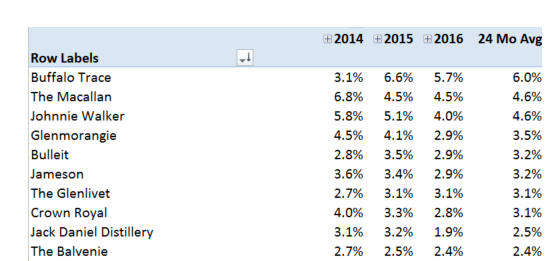

The Scotch whisky labels that garner the most interest for customers are The Macallan, Johnnie Walker, Glenmorangie, and The Glenlivet. Rounding out the top 10 of Scotch is The Balvenie. These are all brands with deep histories and name recognition. Despite Johnnie Walker being named in the above list, consumer interest in blended Scotch as a category has declined overall over the course of the last 24 months.

Key Take Away: With all of the conversation and excitement surrounding bourbon, it’s important not to forget about Scotch. There are still a lot of Scotch drinkers out there. But make sure you focus on single malt Scotch. One way to take advantage of this is for restaurants to create separate lists for whiskey and in particular Scotch and to label that menu as “Reserve List” or something equally eye catching. Listing these high profile Scotches along with this lesser know labels and distilleries can build interest for your Scotch selection and help increase Scotch sales.

Bourbon’s Stand Out

Though single malt and blended Scotch dominates the list of top 10 whiskeys for consumer interest, the whiskey that tops the list by piquing the most interest amongst consumers is Buffalo Trace, a bourbon. The other bourbon entry on this list is Bulleit. Both Bulleit and Buffalo Trace entered the US markets in 1999, and both brands lack the deep historical pedigree of brands like Jim Beam or Maker’s Mark.

Key Take Away: Younger brands have people really interested in whiskey. These brands have helped engineer the whiskey revival, and it’s important to note that these brands are must-have bottles on your shelf. Buffalo Trace has an expansive selection of different labels that are made at their distillery and are distilled with similar recipes, or mash bills, to its namesake brand. Labels like EH Taylor and Elmer T. Lee are great alternatives to Buffalo Trace and are easy cross-sells that come with a higher pricer point.

The Rye is the Limit

Rye Whiskey has also shown tremendous growth in consumer interest over the last two years. At 97% growth, rye is gaining popularity at an unbelievable rate. Though still far behind bourbon and Scotch in popularity, the catalyst for the growth of rye whiskey is far different than the growth of bourbon or Scotch. Rye’s explosion, in part, can be attributed to the emergence of cocktail culture, and specifically, resurrecting old cocktail recipes from an era when rye whiskey was a go-to spirit. Most bartenders today will opt for rye whiskey in a manhattan over bourbon. Cocktail culture could easily be surmised as the force that launched rye whiskey onto back bar shelves again.

Key Take Away: Rye whiskey’s spicy character does really well in cocktails because the bold rye flavors stand up well to mixers and liqueurs. Creating cocktails with rye is a great way to increase sales and customer interest in your rye selection.

Irish Recession

Another trend to note is that Irish whiskey is on the decline for interest in on-premise spaces. The decline in interest has been rather significant, pegged at 32% over the course of 2 years. Though Irish whiskey’s global sales have grown in the past few years, their interest seems to be waning overall in the on-premise space.

Key Take Away: Irish whiskey still has great potential, its US sales growth clearly shows that. But the on-premise market of restaurants and bars has seen a decline in interest. It’s important to carry and stock Irish whiskies that aren’t called Jameson or Bushmills. Irish whiskey’s sales growth has been driven by new brands and brands with less name recognition than Jameson. This is similar to bourbon’s growth being propelled by younger brands. In addition Irish whiskey being driven by young brands, single pot still Irish whiskey is also driver for the category’s growth. This is similar to single malt Scotch outpacing blended Scotch in consumer interest. Ah, to be young and single.

Restaurants and bars should stock brands that are just now making their mark on the spirits industry – brands like Red Breast, Tyrconnell, and Green Spot. These brands offer attractive price points and are gateways to introduce drinkers to Irish whiskey.

If you work in the spirits industry or for a restaurant chain and would like to purchase our full report on consumer interest for whiskey that dissects the data much further, email us at sales@uncorkd.biz.

Of course existing Uncorkd customers have access to this and other customized reporting for free. Visit our website to learn more about our iPad beverage menus.

- 5 Fall Cocktails to Capture the Flavors of Autumn - September 26, 2018

- How Restaurants Can Ignore Sales and Increase Profits - May 9, 2018

- 2018 Spring Wine Trends - April 18, 2018